Chitkara Business School Signs pact with ALPHABETA Inc for FinTech courses

Blog

Accruals as an Investment Strategy

Informed decision and data helps in keeping check on one's emotions while investing. One of the insights that you get from constant back testing on different data sets is the importance of accruals in screening the stocks for investment. Generally, investors value the businesses primarily on their earnings power. Richard Sloan in 1996 documented “Accrual Anomaly” where he found that stocks of companies having low or negative accruals outperform the companies having high accrual.

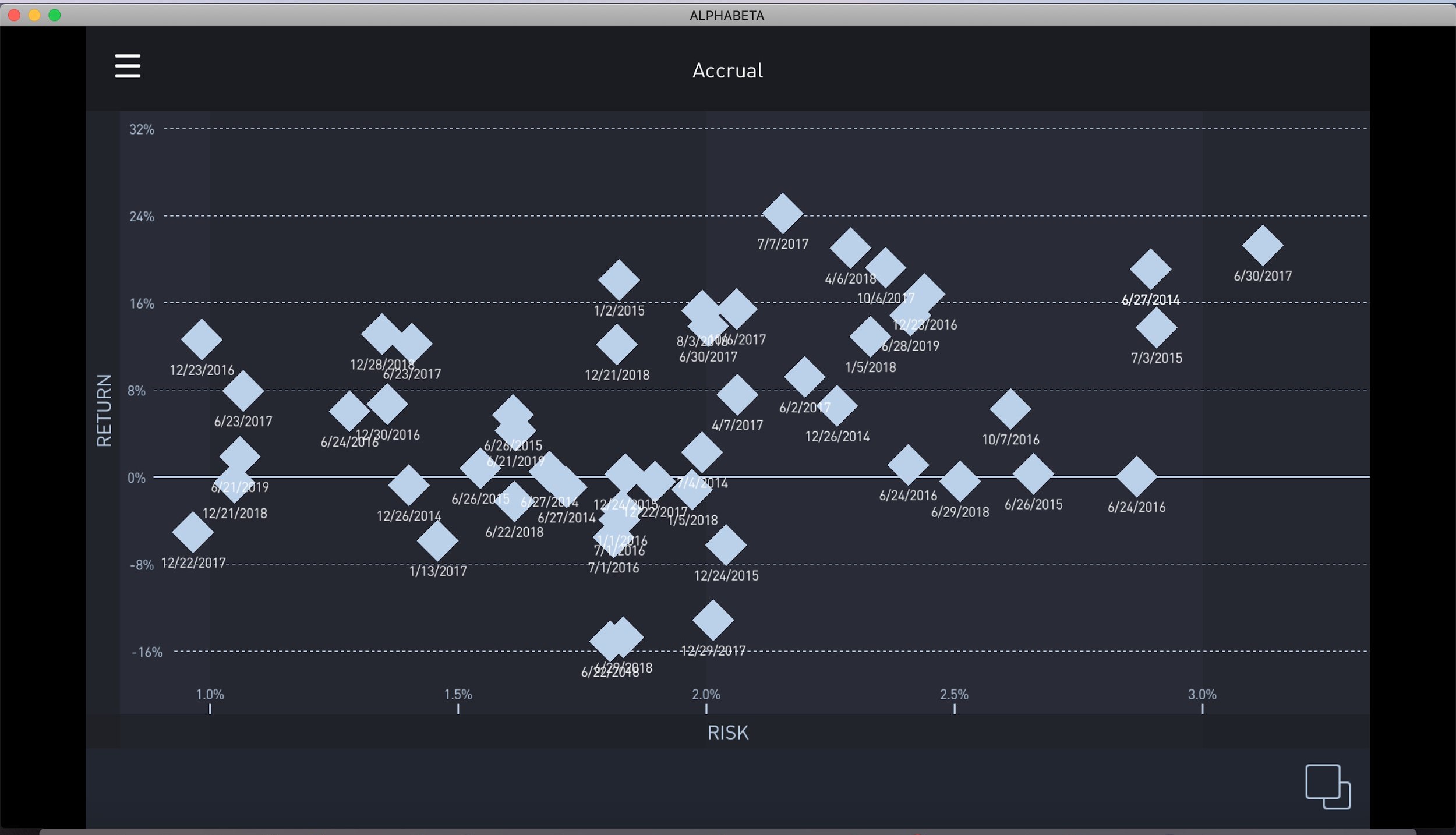

Using ALPHABETA simulate module, I back-tested the NSE-100 stock universe (India Market) from June 2014 till date and found that the low accrual stock group consistently performs better than the high accrual stock group. The groupings were created on the Alphabeta app based on two parameters (Earnings/Price ratio and Accruals/Total Assets ratio). The trading period was 6 months after which portfolios were rebalanced. Low accrual group (stocks with high E/P and near 0 Accruals) gave an average return of 4.9% whereas high accrual group(stocks with high Accruals) gave a return of -8.2%. Low accrual group generated a Sharpe Ratio(risk adjusted returns) greater than benchmark in 6 out of 11 observations. I also noticed that the negative accrual stock group gave a marginally low return, perhaps because it brings into question the efficiency of cash management.

Pic: Spatial view representing performance of Accrual Simulations in ALPHABETA

I also simulated the information technology and communications sector and found that this hypothesis works quite well for the companies in this universe. Low accrual group gave a return of 5.6% whereas high accrual group gave a return of -4.8%. For other sectors, the results were not satisfactory.

Why does Accrual Work?

As an investor we just look in the balance sheet to see earnings and are least bothered about cash generation. We treat highly accrual companies the same as low accrual companies but it has been found that high accrual company earnings reverse in future years. When earnings reverse, investors sell off the stock causing the stock price to decline. In the same manner when low accrual company earnings accelerate in future years, there are high chances that the stock price will gain upward momentum. So when quarterly earnings are announced just don’t trample over the earnings only. Companies don’t make sales solely on cash. They also give away credits which are recorded as accrual in accounting books. Accruals are not bad for a company but they can raise red flags for investor’s in identifying the manipulation.

There is always possibility of manipulation by management in two cases:

Earnings = Revenue - Expenses

- Management expecting low earnings in future, which can be speed up by showing high revenue on accrual sales

- Management doesn’t want to state high earnings so it can pay future expenses in order to smooth earnings for upcoming quarters.

How to spot value in stocks in a post pandemic era

Nifty has had a major correction falling below 8000 after touching 12000 level in November2019. The economic impact of the shutdown by the governments across the world and in India will have lasting impact on all the sectors. There are economic stimulus packages expected and the US has been one of the first one to approve it as well. It might be prudent for investors sitting on cash to spot the sectors and stocks for the next growth cycle. Accruals can turn out to be a good approach.

About the Author:

Diksha Jain is currently working with ALPHABETA as a support team member and in her career moving from a homemaker to a professional stock trader/investor. As a retail investor everyone wishes to be the next Warren Buffet or Rakesh Jhunjhunwala. Many succeed while others fail (probably more). Earlier, as an individual investor her stock picks used to come from news channels, portfolios of big fund houses rather than any systematic strategy which is the case now.

In Diksha’s words: “ALPHABETA helped me develop solid quantitative skills by giving me an experiential learning platform. It helped me to manage risks and reduce losses of my portfolio. Most importantly it taught me to control emotions and take better informed decisions by simulating past data”

Comments