Chitkara Business School Signs pact with ALPHABETA Inc for FinTech courses

Blog

Short Selling in the Indian Stock Market: A brief Walk-through

Shorting is something we generally don’t do in our day-to-day life. You can imagine it like this. We buy a phone, we buy a car. When we don’t need it we can sell it off. Shorting can be considered as the total opposite of it. You are selling a phone or car or even a stock today and buying it back after a few days. Yes, it's difficult to imagine so let's just try to understand it in detail with an example.

Imagine that a famous new sports-bike is going to launch in India soon and there is a lot of demand for it. There was a registration window for buying this bike which is closed now. I have managed to register my name for the bike but my colleague could not register due to some reason but he wants that bike badly. The speculated price of the bike is 1 Lac INR. The exact price will be revealed on the launch date itself. My colleague (who still wants the bike badly) comes up to me and puts an offer to buy the bike from me for 1.1 Lac INR. So I after thinking for some time agree to this deal. So I have sold a bike for 1.1 Lac which I still don’t own nor do I know the exact price for which the bike will be launched.

So now comes the launch date. There are three possible scenarios:

Scenario 1: The bike is launched for 1.1 Lac INR. I buy the bike for 1.1 Lac and sell it off to my colleague also for 1.1 Lac. So there was no net profit/loss in this transaction

Scenario 2: The bike is launched for 1 Lac INR. I buy the bike for 1 Lac INR and sell it off to my colleague for 1.1 Lac as was decided earlier. So I clearly made a profit of 10,000 INR here.

Scenario 3: The bike is launched for 1.2 Lac INR. I buy the bike for 1.2 Lac INR and sell it off to my colleague for 1.1 Lac as was decided earlier. So I made a loss in this scenario. Loss of 10,000 INR

The conclusion here if you look closely is that lower is the launch price of the bike, higher is my net profit. This is the general principle behind Short-selling. Your view is bearish when you are short-selling. So you are selling something upfront today, which you don’t own, at a higher price and are expecting to buy that at a lower price and make a profit out of it in the future.

There are two ways in which you can short-sell stocks in India. One is through the Spot market and the other is through Futures market.

Short-selling in the Indian spot market:

Short- selling is the total opposite of buying a stock. When you are buying a stock, you have a bullish view. You expect the stock price to move up and sell the stock at a higher price. In short-selling your view is bearish, you want the stock price to fall.

Short-selling in Indian spot markets has a major restriction. It can only be done on an Intraday basis. You cannot carry the positions forward on next dates. So you can short sell a stock today during trading hours but you have to buy back the stocks at the end of the day just before the market closes. But, again, it depends, if the service provider/broker provides you this option.

Let me give an example with actual data:-

Let's say today’s date is 18 Sep 2019. Grasim is trading at INR 709.75 at 01:30 PM in the market. I have a view that the stock price will fall from here so I short sell 1,000 quantity of Grasim from my trading account. I will have to use the Intraday square off option in the trading account to execute this trade. So I will have to square off my position today itself. So as explained earlier because of the restriction, I have to square off my position today itself, so I buy it back 1,000 quantity of Grasim at 3:10 PM for market price of say INR 695.20. So I sold it earlier at a higher price and bought it back at a much cheaper price. I clearly made a profit out of this deal.

The profit will be = 1,000*(709.75 – 695.2)= INR 14,550

Incase you forget to square off the position, most of the trading platforms will automatically square off the position between 3:20 PM – 3:30 PM.

Short-selling in Futures Market:

Apart from the spot markets which you already know, there is a huge market for trading called the Derivatives market. The two most common instruments that you find under derivatives are Futures and Options. Derivatives as the name suggests are contracts which derive their value from an underlying asset. The underlying asset can be anything- be it stocks, commodities, currency,etc.

Futures Contract: It is a contract between two parties, where the buyer of the contract is obliged to buy the underlying asset at a predetermined price (futures price) on a predetermined date called expiry date and seller is obliged to sell the same at the same predetermined price on the expiry date.

Nifty Futures:

For Nifty futures contracts, expiry date of the contract is every last Friday of the month. You can find 1month, 2month and 3month futures contracts on NSE. Every month contract will have an associated futures price.

So I can buy/sell any of the three contracts at the current market price of that particular Nifty futures contract. Point to be noted here is that I can’t trade in Futures contracts with any quantity. For example- I can’t just buy/sell 1 Nifty contract. I can only buy/sell a minimum of 75 contracts(1 Lot) or multiples of 75.

For buying/selling Futures, there are certain obligations which a trader has to comply to:

1. Mark to Market: MTM is an accounting process that involves balancing the Profits/Losses made daily by the buyer/seller of the Futures Contract. The profit/loss is balanced every day after market closure and the close price for the day becomes the new price of the contract. Every day, this process is followed until the contract is closed or expired. If there is a loss on a particular trading day, the loss amount is deducted from the exposure margin (explained in next section). When the losses become more than the exposure margin, the Broker asks the Trader to add more funds in his account. This is called as Margin Call.

2. Initial Margin: Initial margin is deducted from the trading account of the trader when he opens a Futures position.This margin money consists of SPAN as well as Exposure Margin.SPAN (acronym for Standard Portfolio Analysis of Risk) is an initial margin requisite that is based on the risk level and volatility of the underlying. Higher the volatility, higher is the SPAN margin.Exposure margin is blocked over and above SPAN to give a cushion to Mark To Market (MTM) losses. Exposure margin is currently 3% of the notional value of the contract for Index Futures. For Single Stock Futures, the higher of 5% or 1.5 standard deviation of the notional value of gross open position in futures on individual securities.

This Margin amount is generally a big amount and is higher when the volatility in the markets is higher. For example, Nifty50 1 lot (75 units) has a total margin of around INR 90,000.

Example to illustrate Nifty Futures: I have a bearish view for Nifty so I sold 1 lot of Nifty Futures contract with 26th Sep expiry for ?10,880 today in the morning. Margin Money which will be the sum of Span and Exposure margin (around 90,000 for 1 lot) will get locked from my trading account. Now say tomorrow the Nifty futures price goes up, say to 11,000. So I have a notional loss now. So that amount gets reduced from my Exposure Margin. Daily based on movement of Nifty futures price, margin amount changes. This is the MTM that was explained earlier.

Now if instead of going up the market would have gone down, say to 10,600, I can simply buy back the 1 lot of Nifty 27th June Contracts and square off earlier contract. So I make a profit of (10,880-10,600)*75 which is equal to INR 21,000.

I can also keep the position open, if I sense that Nifty will go down further thereby increasing my profit, but eventually my positions will expire on 26th Sep 2019 at 3:30 PM. So whatever is the profit/loss at that time, it will get automatically booked to my account and the margin will be released

Stock Futures

Along with indices, you can buy/sell stock futures as well in Indian markets. Point to be noted is that every stock which is traded in Derivatives market has Futures Price which is different from the spot price, but moves very closely with the current spot price. So trading in Futures is based on the Futures price. Similar to Nifty, stocks also have 3 contracts running parallely- 1month,2month and 3month expiry.

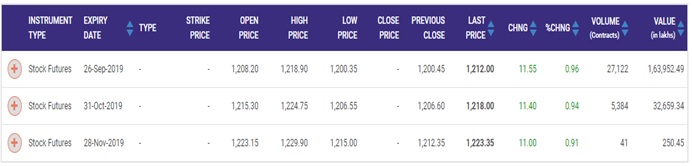

Example: Reliance Industries Limited has 3 contracts running parallely as of Sep 18th, 2019 as shown on NSE website(screenshot attached at the end of this blog)

I can buy/sell any one of these 3 contracts shown in the screenshot from NSE website. Lot size of Reliance is 500. Exact Margin requirement varies from broker to broker. Lets take Zerodha for example. Margin requirement for Reliance Futures (Sep Expiry) is around INR 1,07,049 for 1 lot as shown in the screenshot below taken from Zerodha website.

Say I am bearish on reliance futures and I sell 1 lot (500 quantity) of Reliance September expiry futures contract at todays last price (INR 1,212). Margin requirement (SPAN+Exposure) as shown in Zerodha is around INR 1,07,049. This amount will get locked from my trading account. Now say tomorrow the Reliance futures price falls goes up to INR 1,250. I have a negative position at that time, so this notional MTM loss will be taken care of by reducing the same amount from the Exposure Margin that I had paid earlier. MTM loss amount will be calculated as price movement multiplied by lot size (1,250 - 1,212)*500 = INR 19,000.

Now if instead of Price moving up to INR 1,250, it would have hypothetically gone up to INR 1,350. So now my notional MTM loss would be (1,300-1,212)*500= INR 44,000. This amount is higher than the Exposure margin (INR 42,844) that I had paid while entering the contract. So here by the end of the day broker will send a Margin Call of (44,000-42,844)= INR 1,156, which I have to pay immediately.

So you can clearly see the quantum in futures is huge even for 1 lot. If the Reliance Futures would have gained by 100 points, I would have had to pay INR 50,000 as the MTM. I cannot carry forward my position to the next date if I don’t pay the MTM margin. Also there is a hefty penalty from stock exchange, if the obligations are not met.

In spot market there is no MTM margin requirement. If you have a negative position, there will be an unrealised loss which will get carry forwarded to the next date without having to pay any extra margins.

Limitations of futures:

- Dangers of Leverage: If you look at my example above. I bought Reliance futures 1 lot (500 quantity) for INR 1,212. So my contract value is 500 * 1,212= INR 6,06,000 but I paid just around 1 lakh as Margin. This is called taking leverage. So just imagine a hypothetical situation where Reliance futures price crashes badly by 50% and becomes INR 606, so my position value will now be (500*606)= INR 3,03,000. The net loss will be INR 3,03,000 for that day.This is almost 3 times my initial investment amount which I gave as Initial Margin. This can work in my favour as well if the stock were to go up by the same percentage. The quantum of profit as well as loss is huge in Futures.

- MTM Margin requirement: As explained earlier there is a daily need to maintain any margin call requirement, failing which your broker can square off the position as well as charge a penalty.

- Futures contracts are complicated and can be difficult for new traders to understand. Each contract has a different lot size and different margin requirements which may be difficult to understand.

- Another major risk here is the amount of liquidity in Single Stock Futures is low when compared to Spot markets. Many time the your trades won't go through unless you buy at a premium and sell at a discount.

This is a glimpse of how short-selling works in Indian markets. It is easy to short-sell on intra day spot markets. Futures markets are much broader and offer higher flexibility in terms of keeping the trade open for multiple dates. But in the case of futures, initial margin as well as daily MTM is generally very high and so new investors generally are advised to be very cautious while entering Futures market.

There are certain strategies where you can apply short selling. Pair Trading is one such based on Relative Value Arbitrage. Another strategy involves Momentum based trading. Here you go long on the stocks that have shown an upward Momentum based on past 52 weeks data and you go short on stocks that have shown downward momentum. More content will be added on these strategies on my upcoming blog.

Comments